Raza Naqvi didn’t realize how much his student loan debt from attending Temple University would affect him after graduation.

“When you’re applying to college, you don’t really think about that,” said Naqvi, a 2017 biology alumnus. “You just know you need to pay for school.”

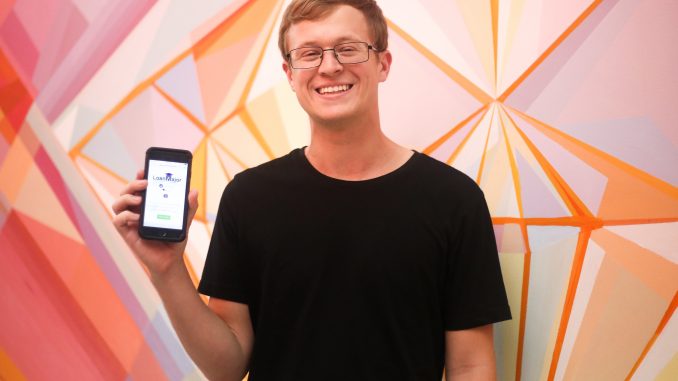

To help students like Naqvi, 2017 finance and real estate alumnus Mason Gallik launched LoanMajor, an online company helping college students and graduates manage their student loans.

Gallik started the company in February with the help of Blackstone LaunchPad, an entrepreneurship program in the Student Center that supports and mentors students and alumni.

“I still see a lot of people who even by their third or fourth year of college don’t know what the different loans are,” Gallik said. “They don’t know what loans they should be taking [out].”

According to a Federal Reserve Bank of New York 2018 quarterly report for April through June, student loans make up 11 percent of total household debt, behind mortgages – the leading category which accounts for 68 percent of total debt.

Naqvi said he was concerned with how paying back his loans would change his financial situation. So, he turned to LoanMajor for help.

The free tool has two main calculation systems to help incoming college students understand the process of taking out loans. The College Search Calculator estimates the total loans the student will have to withdraw and the monthly payment that will be made to colleges based on average tuition prices calculated from family income and contributions from the student and family members. The College Selection Calculator compares the financial aid packages students can expect from colleges to which they’ve been accepted.

The company also has a College Price Search feature that calculates the average price of college based on the student’s family’s income.

Gallik said LoanMajor’s goal is to help students estimate what they are going to owe in loans and what their monthly payments and starting salaries will be based on data from the 2016 American Community Survey.

For college graduates, LoanMajor offers the Refinance Loan Calculator, which estimates how much students will save on interest rates and monthly payments by refinancing their highest-interest-rate loans.

Refinancing a loan means a business revises the interest rate, payment schedule and terms of a previous credit agreement. This can often result in better savings on loan payments.

After Naqvi used the software to figure out how he should refinance his student loans, he said his interest rate dropped from 8.9 percent to 6 percent. This saved him $25,000 through debt consolidation, a process in which a new loan is paid off over a longer period of time at a lower interest rate.

While LoanMajor doesn’t refinance student loans, it refers people free of charge to lenders who can. Gallik said when students refinance a loan with those lenders, LoanMajor earns a referral fee, which is where all of its profits come from. The company collects user data, but does not sell it.

He added the loan refinancing process is a tradeoff, with students accumulating less student debt through a new loan.

“Your debt number is still going to be the same,” Gallik said. “[But] we want your monthly payments lower and your interest rate lower.”

Julie Stapleton Carroll, the program director at Blackstone LaunchPad, worked with Gallik on creating some of LoanMajor’s features. She said the staff met with Gallik three times to help him launch the business through one-on-one coaching.

“[Gallik] came in having already developed the rough outline of the product, and wanted to know how to get it to the next stage,” Stapleton Carroll said. “We worked with him on how to market the calculators, how to test it, how to get it in front of potential users and working with social media and marketing.”

In addition to its calculation tools, LoanMajor’s website provides information on in-state and out-of-state tuition, the Free Application for Federal Student Aid, scholarships, types of college loans, interest rates and different ways to repay loans.

Gallik said LoanMajor’s calculators are designed to help students make sense of their college investments and help them avoid making two common mistakes: attending a college that’s too expensive and choosing a major that won’t be lucrative.

“Then you can try to pursue a career path that is sustainable,” he added. “So you’re not going in blind and borrowing $100,000 and coming out only making $30,000 a year.”

Naqvi, who lives paycheck to paycheck and estimates he spends half his monthly income on student loan payments, said the cultural norm is to go to college by any means necessary.

“But you should know what you’re getting yourself into,” Naqvi said. “I definitely learned a lot [from LoanMajor]. I wish I had started sooner.”

Be the first to comment