The death of a child is a level of pain no parent ever wants to experience. But for the mother of a Temple alumnus who died in August 2011, financial stress has also surfaced as a result her son’s passing.

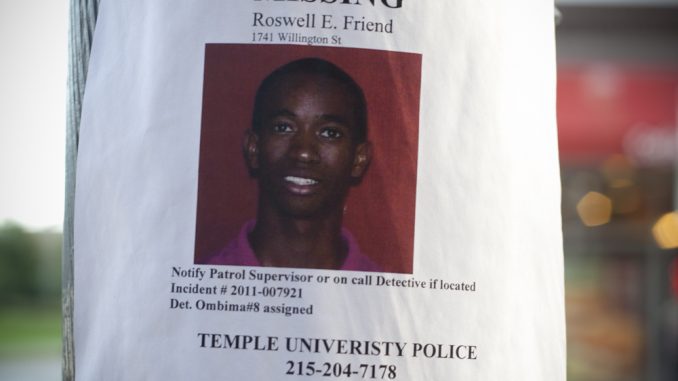

The late Roswell Friend, 22, passed away between Aug. 18 and Aug. 23 of last summer. A member of the men’s track & field team before graduating in 2011, he was last seen going on a run.

Housemates found a note on a whiteboard from him that read: “I’m sorry guys.” Days later, his body was found in the Delaware River.

His mother, Regina Friend, a year after the untimely passing of her son, was recently informed that she owes $14,000 in taxes to the IRS on a $55,400 Parent-PLUS loan taken out to pay for her son’s education.

Roswell Friend transferred to Temple from Morgan State University to major in broadcasting, telecommunications and mass media and to compete on the men’s track team.

“I was excited,” said Regina Friend, recalling the day her son’s Temple acceptance letter arrived. “Then I went online, looked up the tuition, called him and said, ‘How do you plan to pay for this?’”

Regina Friend said that Temple was significantly more expensive than Morgan State and, in order to compensate financially, she applied for and received a parent-plus loan.

Parent-PLUS loans are taken out by a parent, as opposed to the child, to help pay for college tuition among a slew of other expenses. Regina Friend borrowed $55,400 on behalf of her son, she said.

“He was doing something positive. I’m not having to borrow money for something that’s negative. So I’d mortgage my soul,” she said. “All parents do it.”

Roswell Friend had received a job offer from Comcast and with his starting salary, his mother said, the Parent-PLUS loan would have easily been paid off.

After her son passed, the loan was forgiven by lender Sallie Mae. This appeared to be the end of her financial troubles until she was informed that the IRS had taxed her $14,000 on this gain.

In an email, financial professor Ronald Anderson explained the government’s motivation.

“This situation is like the exact opposite of winning a lottery,” Anderson said. “IRS rules dictate that when an individual has a windfall gain, that taxes must be paid on the gain.”

He also said that the government only forgives this tax in cases of mass federal crisis.

“Unfortunately, with Roswell’s death, this is tragedy piled upon tragedy,” Anderson said.

Roswell Friend’s former housemates, who he lived with on Willington Street until his death, were unaware of the financial troubles that his mother now has to face in the wake of her son’s death.

“It was a surprise to us,” former housemate Travis Mahoney, a senior exercise and sports science major who also competes on the track team, said. “We didn’t even know [he] had any loans, we thought it was all paid for.”

Mahoney said that he and other friends sold wristbands in honor of Roswell Friend, to help ease the financial burden of the funeral costs immediately following the incident.

Other friends also sought to raise funds through a program called Friends4friend. These students donated their profits to suicide awareness.

Though these two fundraising efforts succeeded, none directly sent money Regina Friend’s way for the purpose of paying off the debt she now faces.

Regina Friend is still looking for ways around the IRS charge, expressing that she is looking not just for herself, but for all the other parents who face similar issues.

Her taxes will be filled in the coming weeks if a solution is not found for fear of additional charges on top of the $14,000 fee.

“It’s just a shame that she can’t just be allowed to move on, I mean she can’t really move on, but be allowed to stop dealing with this [and be at the point] where things don’t keep piling on one year later,” Mahoney said.

“I cannot tell you how hard this is,” Regina Friend said.

Cindy Stansbury can be reached at cindy.stansbury@temple.edu.

Be the first to comment